MNLSH ALGORITHM

A robotic portfolio management system developed over 14 years of scientific, economic, risk and artificial intelligence research.

MNLSH is engineered to extract capital returns from global financial markets.

What is the MNLSH Algorithm?

Electraphysics MNLSH is an algorithmic black-box (machine).

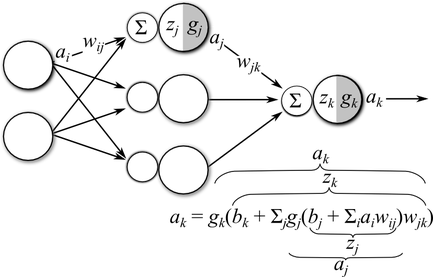

MNLSH manages a system of neural networks, evolving adaptively by learning from errors.

MNLSH consists of five distinct algorithms:

MILA Foreign Exchange

NOUR Crude Oil and Natural Gas

LIZA Crypto and Digital Currency

SHER Equities and Indices

HEER Precious Metals

Each manage a different class of assets and collaborate tactically for superior portfolio and risk management in one unified system.

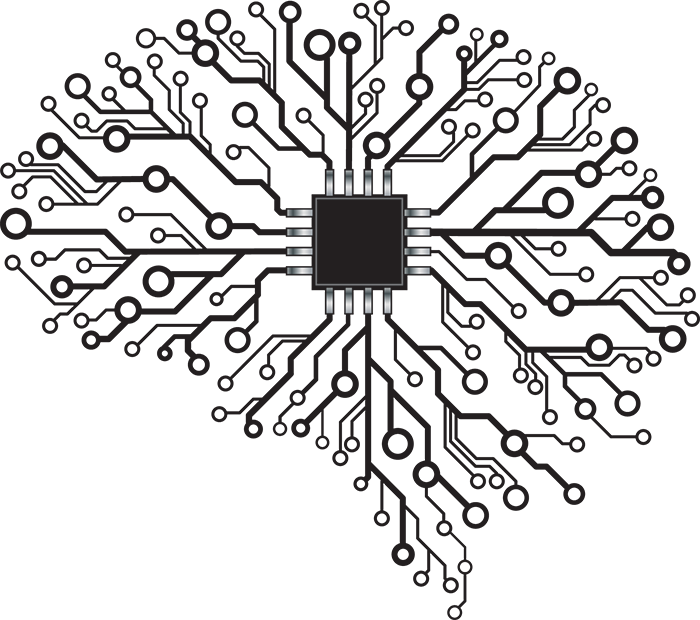

Self-Optimization

MNLSH utilizes real-time stochastic gradient descent.

Efficiently calculating permutations of adaptation for self-optimization in artificial intelligence.

MNLSH continuously self-optimizes to operate in changing market regimes.

Intelligent Decision-Making

MNLSH's neural networks consider the "what ifs" of alternative trading decisions.

Analyzing the outcomes and consequences of decisions, MNLSH tests and verifies over historical data, deriving logical conclusions.

This analysis determines the paths in the present that are ideal for learning, most importantly - why.

Tactical Capital Management

MNLSH's tactical use of multiple algorithms, strategies, mathematics and psychology determine the best trades to execute and manage.

It does not possess human fallibilities and limitations such as: Fatigue, inconsistency, emotions of fear and greed.

During its' experience, it has created a statistical memory of positive and negative decisions both qualitatively and quantitatively defined.

Technical Strategy

MNLSH analyzes major technical indicators but does not rely on indicators.

Its' decisions are based on probabilities.

MNLSH examines data to uncover strategies embedded in price behaviour.

Upon detection of an embedded strategy, MNLSH creates itself a new strategy mix into the portfolio.

Automatically allocating capital and conducting portfolio re-balancing.

Historical Analysis

Electraphysics MNLSH travels to past historical data, considers new decisions, acts upon them and determines the probabilistic outcome.

In a concurrent state of back-test, forward-test and present live-trading.

MNLSH is in three states simultaneously.

In its' data-centric, statistical world, its' algorithms exist in multiple dataset time frames.

Analyzing hypotheses in the past, present and future. It shares information between itself in these three-time frames simultaneously and instantaneously.

MNLSH is in a state of continuous portfolio self-optimization.

Acquiring important data about surrounding economic conditions in multiple markets, assessing statistical correlations and building sentiment-consensus profiles.

It creates and monitors a regime delta.

Linguistics, Text & Macroeconomics

MNLSH can not just read but understand the news, utilizing a mechanism of statistical word frequency clustering and implementing classical techniques of recursive parsing in grammar.

This filter assists its' understanding of human languages, codifying market behaviour and reactions to form a unique psychological index.

Considering Macroeconomics from a variety of sources, it develops a unique sentiment index.

Able to comprehend language for knowledge but also identifying embedded intrinsic psychology.

This area of comprehension of language in its' design is based on research in theories of 2nd-language acquisition in linguistics and subjective interpretation problems found in philosophy.

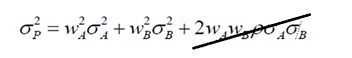

Low Correlation

MNLSH is designed to maintain low correlation with traditional assets such as the S&P500 and managed mutual funds.

Thereby not increasing portfolio risk by its' inclusion.

MNLSH provides diversification benefit in your existing portfolios.

Physical Hardware & Network Connectivity

Electraphysics MNLSH runs on a 96 Core Server with 192 threads.

(The average high-performance desktop computer has 4 cores).

Electraphysics' hardware is in Linux Server configuration with:

- Linux/Unix-Based Security.

- Supermicro SuperServer 8048B-TR4F MP Xeon E7-4800/8800 with Redundant 1400W Power Supply

- 4x Intel Xeon E7-8890 v4 2.20GHz (3.4GHz TB) 165W 60MB L3 (96 Cores / 192 Threads)

- 4x Dynatron R14 60mm 2 Ball Intel Sandy Bridge Romley-EP/EX Narrow ILM CPU Fan

- Antec Nano Diamond Thermal Compound Formula 7 w/ Diamond particles

- Supermicro X10QBL-4 Server Board Quad Xeon E7 LGA 2011 Super Motherboard

- 2048 GB (32 x 64 GB) 288-Pin DDR4 SDRAM 2400 (PC4-19200) ECC Server Memory

- Crucial MX300 275GB SATA III 3-D Vertical Internal Solid State Drive (SSD)

- SAMSUNG 860 Pro Series 2.5" 4TB SATA III Solid State Drive (SSD)

- LSI MegaRAID SAS 9361-8i 12Gb/s SAS, SATA RAID controller W/1GB DDR3 1866MHz Cache Memory

- Intel X520-DA2 Dual SPF+ Ports 10 Gigabit Ethernet Converged Network Adapter - Fiber Optics

- CyberPower 1500PFCLCD Dedicated UPS system.

Electraphysics MNLSH has an average up-time of 99.9% and is connected to multiple cellular and fiber-optic data-pipelines to major exchanges worldwide.

In the event of global crises such as: War, terrorist threat, cyber threat, financial/economic crises, black-swans and geopolitical uncertainty.

MNLSH is prepared to manage unpredictable challenges.

Performance

MNLSH has over 10+ years of experience in various economic conditions and phases of the business cycle.

To learn more about MNLSH, feel free to contact member or R-ALGO services.

R-ALGO

MNLSH

About Us

Team Access

Electraphysics MNLSH accelerates returns by utilizing:

- quantitative stochastic statistical models

- artificial intelligence and machine-learning algorithms

- adaptive neural networks

MNLSH offers portfolio-managers, positive return generation and diversification as part of a multi-strategy approach.

Electraphysics MNLSH is a transparent electronic portfolio management system:

- State of the art Web/Mobile Interface Console.

- Built-in duplex fund transfer system.

- Support for 50+ different currencies, including Gold and Silver.

LEARN MORE

Assets Research

R-ALGO | Membership