[M][N][L][S][H]

A robotic asset-management system developed over 14+ years of research.

Our systems are engineered to manage ultra-high capacity AUM.

The Machine

Powered by five scientifically engineered AI algorithms:

MILA, NOUR, LIZA, SHER, HEER

Collaborative portfolio management in one unified system.

Self-Optimization

Continuous self-optimization.

Adapting to market dynamics and regime shifts.

.jpg?crc=273325166)

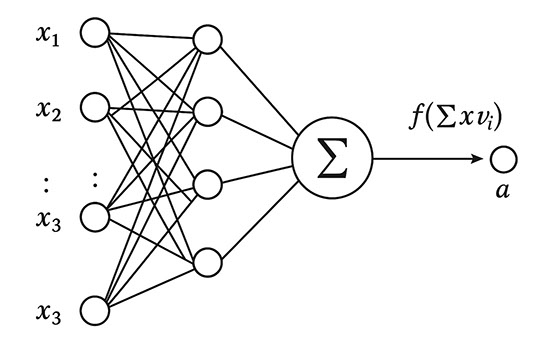

Adaptive Neural Networks

Considers the what ifs of investing decisions.

Forecasting asset prices into the extended future.

Tactical Capital Management

Dynamic asset allocation and automated portfolio re-balancing.

Seizing short-term opportunities from long-term SAA .

Generating more alpha.

Autonomous Strategy Discovery

Examining fundamental, accounting and price data.

Discovering embedded strategies and leveraging them at scale.

Historical Simulation

Simulating hypothetical decisions through historical analysis.

Self-optimizing strategies & risk-return metrics.

Deep Corporate Monitoring

Fundamental, financial statement and sentiment analysis.

Understanding text, audio and video.

Real-time monitoring of financial reports, social and news-media.

Low Correlation

Maintains low correlation with traditional assets such as the S&P500.

Superior diversification benefit in your existing portfolios.

Strong Risk-Adjusted Returns

Exceptional annualized Sharpe and Sortino ratios.

Portfolio growth with significantly lower volatility.

Physical Hardware & Network Connectivity

Operating on a 192-Core AMD EPYC Server with 384 threads.

MNLSH has an average up-time of 99.9%.

Performance

10+ years of experience in various phases of the business cycle.

International Tel: 1-800-729-0631

Monday to Friday 8 AM - 4:30 PM EST.

Institutions

MNLSH

CAPITAL OPTIMIZATION